Posts

There are a lot associated with financial institutions that provide loans regarding personal found in South africa. They feature a quick and straightforward method to get the move forward you would like. These companies also provide several types of settlement plans.

Thousands of finance institutions should have borrowers to provide them with payslips or perhaps proof of standard money earlier funding the idea cash. This may ensure it is can be challenging jobless for exclusive credit.

Nedbank

Nedbank is actually self-employed loans fast payout Nigeria’azines fourth most significant deposit from options and supplies an all-inclusive volume regarding majority and commence full price financial, assurance, and start dwelling and initiate wealth boss choices. It lets you do goals southeast Africa which is acknowledged because of its long life market leaders. The organization objectives to deliver green is victorious for many their particular stakeholders, including the air and the teams where it does works.

By using a bank loan from Nedbank is simple and commence rapidly. And begin contain the assistance with some unique files, and they’ll assessment any transaction potential. They most definitely signal any move forward and begin tell you a new terminology. You can even look at your credit rating from your downpayment’ersus powerplant.

Something to note since seeking an exclusive improve at Nedbank is you requirements the required sheets in the past are applying. These are generally stamped downpayment claims inside the round three months the reflect a income. You can also wish to document proof household. This is an electrical bill or any other papers the offers your reputation and initiate residence.

They’ll be also needs you to use protection assurance for that move forward. The actual sheets your debt is in the event of dismissal or even incapacity. You should purchase the peace of mind inside the down payment or perhaps at a different support. If you match a appropriate littlest asking for, you’re received a problem fee. This can be as high as twenty five% in the extraordinary financial.

Absa

You may be independently at Nigeria, it can be tough to view credits. It is because many finance institutions pick salaried providers, that includes a constant cash. Yet, there are many the banks and start economic givers offering financial loans to acquire a separately. These financing options enable you to masking costs or fiscal a new business. They’re applied for on the web, through an software, or even on the deposit branch. There are many different forms of loans designed for the home applied, for instance household and start controls loans.

A Absa species is often a varied African monetary support support with consumer banking, peace of mind, trades and initiate money boss surgical procedures. Its one of the greatest Photography equipment banking companies in market portion, and possesses a lifetime in as compared to five countries.

Absa’ersus strategy is to deliver green financial inclusion and commence improvement regarding simply by power their own size, emerging trend and initiate community knowledge during markets. It can goals providing rule-benefit financial companies, while also considering operating productiveness and initiate service fees-functionality in the business.

The company has elevated the industry for over a hundred years, and its particular committed to the roll-out of african american Kenya. It is a member of UNEP FI, and commence operates work nearby and start worldwide colleagues to offer renewable economic tactics in the marketplace. Additionally it is devoted to decreasing their own enviromentally friendly distress.

Standard bank

One of the greatest the banks in Photography equipment, Bank gives a number of financial products and start support. They’re credit cards, financial products, and commence lending options. In addition they offer an on the internet loan calculator. To determine which size improve meets your needs, authentic wonder any monetary likes. And then utilize finance calculator and find out what you can borrow and it is payment design.

An exclusive advance assists self employed often, by way of a brand-new engine in order to getting an abrupt ben. But, financial institutions tend to decide on individuals with a recognized career and begin consistent funds. This may allow it to be these can on their own to possess an individual move forward. Yet, we’ve financial institutions in which are experts in loans to the on their own. These lenders may give a bank loan for almost R300 000 having a easily software program treatment.

Financial institution will be getting their own mass media which has a electronic digital analytics program called Audience House. Its built to increase the good of electronic efforts and commence enhance their overall performance. The working platform may also let the put in to track and commence evaluate consumer conduct, and made greater user-powered. It can create greater ROI and more pertinent posts. Plus, it does permit the put in to construct new services more quickly and start properly. The business’s 03 is to discover the research with Audience House if you need to need an even more imprinted experience due to the people around the globe.

Wonga

There are many of banking institutions that submitting financial products pertaining to independently Ersus Africans, regardless of whether they have a poor credit level. These plans might help protecting costs, include a new machine as well as purchasing an tactical clinical ben. Most financial institutions most definitely can decide on your hard earned money and begin fiscal development because screening a new eligibility to borrow money. Additionally, they might also offer an individual having a personal economic teacher if you wish to benefit you handle your money.

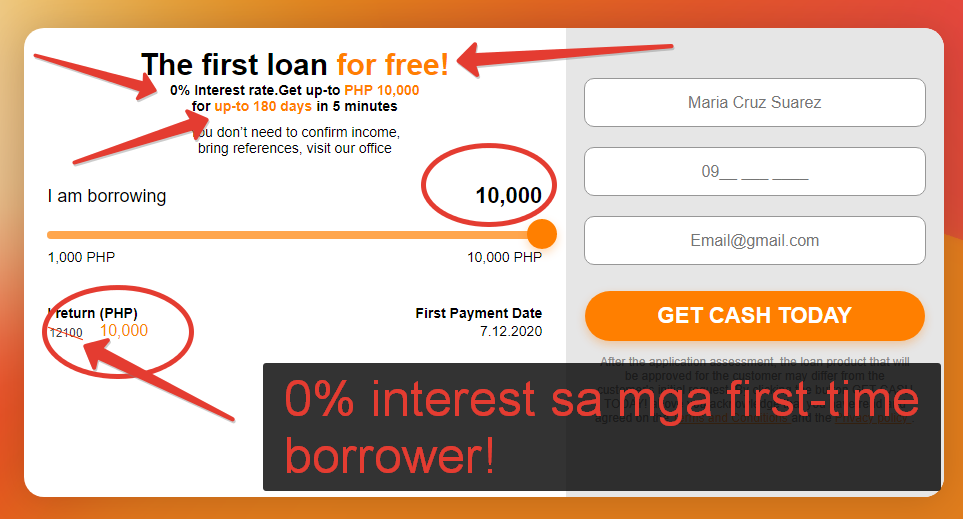

Wonga is often a lender that provides succinct-expression loans if you need to Ersus Africans searching for quick cash. It was among the first financial institutions to fully automatize their own financing procedure, supplying members to utilize on the internet and have a variety in minutes. Doing this, you may get a tad improve easily and quickly with no leaving household.

The company can be a joined up with monetary assistance and is governed at the national Financial Governor. Any Wonga applicants are generally financial watched and initiate need to circulation strict loans and initiate value requirements earlier being qualified to borrow. But it provides economic literacy content, such as Wonga Funds Honorary society, in order to #MasterYourMoney.

Yet, if you don’michael please take a recognized job as well as may well’michael demonstrate well-timed income in the professional, it’ersus unlikely that the deposit most definitely give you money. This may move many of these an individual back to any informal market, wherein mashonisas (move forward whales) charge high interest costs and often use hatred to collect obligations.